One of the main reasons why states like Nevada and New Jersey have permitted online poker is because there is a huge upside in revenue that is derived from taxes. Online poker players end up winning huge sums of money on a regular basis and all of it is taxable as per U.S. law.

One of the main reasons why states like Nevada and New Jersey have permitted online poker is because there is a huge upside in revenue that is derived from taxes. Online poker players end up winning huge sums of money on a regular basis and all of it is taxable as per U.S. law.

The state of Nevada which legalized online poker in 2013 is now looking to collect taxes from online poker players who won in 2013. Before legalizing online poker, Nevada along with other states like New Jersey and Delaware had put strict regulations in place that would carefully monitor all online transactions and player winnings.

These records can be monitored by the Internal Revenue Service who have the means to track all online poker transactions, deposits and withdrawals.

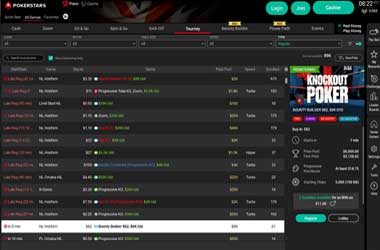

However, Nevada is the only state has not signed a data-sharing pact with the IRS. Hence, UltimatePoker.com, WSOP.com and RealGaming.com, the three online poker websites that operate in Nevada do not share these details with the IRS. Yet, if required, the IRS can petition the federal government who has the right to issue summons and get data on any player or website as required by federal law.

This means that all online poker websites must keep a careful tab on all transactions as they could come under scrutiny of the authorities at any given point of time. If there are any suspicious transactions, these websites will not only be investigated but could also be shutdown.

Brad Polizzano, Gaming and New York tax attorney was of the opinion that since these websites just launched, there will not be any major concerns as it is too early in the game.

He also stated that poker players have realized that their transactions are carefully being monitored and will hence be pretty straightforward in their winnings and taxes.

As of now the rules state that a player must use a W2-G tax form to report his winnings, if they win over $600 in a “freeroll” tournament and there is no dollar amount for the buy-in, or if they win a net of over $5,000 in a tournament. Many casinos automatically withhold 25 percent for the government and most poker players are happy with this as this means they do not have to worry about filing taxes for their winnings as it has already been accounted for by the Casino.

Polizzano stated that after a few years it could become a lot more harder to monitor these transactions as inter-state poker launches and the number of players grow. However, authorities will keep a careful watch and the amount of each transaction and the total revenue being generated by each of these websites. If there is anything unusual, authorities will come down heavily on both the website and the players involved.